-

Global

-

Africa

-

Asia Pacific

-

Europe

-

Latin America

-

Middle East

-

North America

- |

- Partners

- |

-

Currency:Localize your Content

You can set your preferred currency for this account.

Choose a Currency

Currency- CHOOSE YOUR CURRENCY

Update Currency

Changing Currency will cause your current cart to be deleted. Click OK to proceed.

To Keep your current cart, click CLOSE and then save your cart before changing currency.

-

Select Account

Switching accounts will update the product catalog available to you. When switching accounts, your current cart will not move to the new account you select. Your current cart will be available if you log back into this account again.

Account# Account Name City Zip/Post Code CANCELPROCEEDMy Account

-

Support

- View All Productivity Solutions

- Warranties

- Patents

- Global Locations

- Technical Support

- Discontinued Products

- Quality Program and Environmental Compliance

- Return Material Authorization (RMA)

- Legal Documents

- Product Certification

- Software Downloads

- Cyber Security Notifications

- Case Studies and Success Stories

- View All Sensing Solutions

- Sales Contact Form

- Technical Support

- Certificates

- eCOM Portal

- Distributor Inventory

- Return Material Authorization (Test & Measurement)

- Return Material Authorization (Citytech)

- Return Material Authorization (EnviteC)

- Legal Documents

- Intelligent Life Care

- Return Material Authorization (ILC)

-

Global

-

Africa

-

Asia Pacific

-

Europe

-

Latin America

-

Middle East

-

North America

- |

- Partners

- |

You are browsing the product catalog for

You are viewing the overview and resources for

- News & Events

- Featured stories

- 10 Macro Trends Behind the Emergence of Micro-fulfillment Centers

10 Macro Trends Behind the Emergence of Micro-fulfillment Centers

10 Macro Trends Behind the Emergence of Micro-fulfillment Centers

John Dillon

August 13, 2020

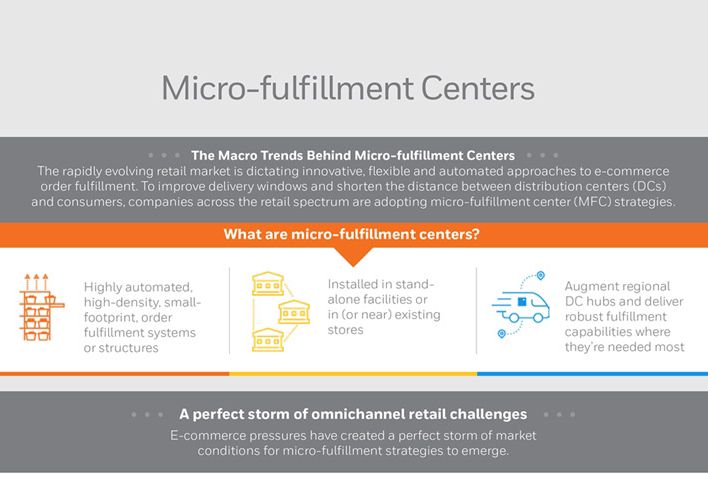

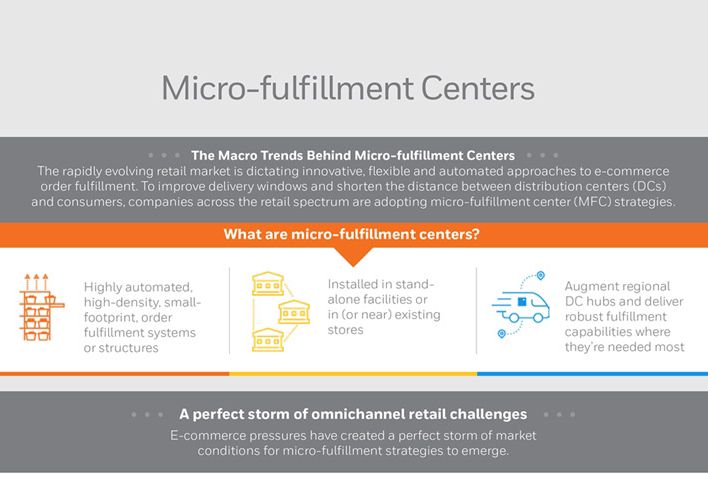

The rapidly evolving retail fulfillment market is dictating innovative, flexible and automated approaches to e-commerce order fulfillment. To improve delivery windows and shorten the distance between distribution centers (DCs) and consumers, companies across the retail spectrum are adopting micro-fulfillment center (MFC) strategies. MFCs deliver highly automated, higher-density, small-footprint fulfillment where it’s needed most: in stand-alone facilities or in (or near) existing stores.

By adopting a micro-fulfillment strategy, companies can establish a hub-and-spoke distribution model — utilizing their regional DCs as hubs while leveraging MFCs as spokes located within proximity to urban population centers. Not only does this shorten the distance for last-mile or last-hour delivery, it also supports in-store pickup for retailers offering “buy online, pick up in store” (BOPIS) fulfillment models.

From consumer expectations for same-day delivery and curbside pickup to the rise of urbanization and escalating labor challenges, the unrelenting complexities of e-commerce fulfillment have created a perfect storm of market conditions for micro-fulfillment strategies to emerge. Here are the top 10 macro trends behind this emergence:

- E-commerce growth — Worldwide e-commerce sales are poised to double between 2018 and 2023[1]. As more consumers are purchasing through their preferred online channels, retailers need to support both direct-to-consumer delivery and BOPIS fulfillment models.

- Rising delivery expectations — 56% of consumers between the ages of 18–34 expect same-day delivery[2]. These demanding service level agreements (SLAs) are dictating the need for significant improvements to last-mile or last-hour delivery methods and fulfillment strategies that move inventory closer to consumers. Traditional manual fulfillment processes will struggle to keep pace.

- Click-and-collect — 67% of shoppers in the U.S. have used BOPIS fulfillment options, which are commonly referred to as “click-and-collect” or “curbside pickup.” It’s estimated that 10% of all sales will be fulfilled by click-and-collect by 2025[3]. Meeting BOPIS SLAs can present disruptions to both their in-store operations and profit margins.

- Urbanization — 54% of the world’s population live in urban areas; this figure is expected to grow to 68% by 2050[4]. Establishing smaller facilities in closer proximity to these high-population centers significantly improves last-mile (or last-hour) delivery. Brick-and-mortar e-commerce retailers can leverage their existing stores for a geographically dispersed urban distribution network.

- Declining warehouse space — Industrial and logistics real estate vacancy rates remain near historic lows in 2020[5]. Retailers may find it more difficult and/or cost-prohibitive to invest in the space needed to establish a traditional DC footprint. Traditional stores typically have limited available storage space and will need high-density options to create effective in-store fulfillment strategies.

- SKU proliferation — The seemingly limitless expansion of product varieties and diverse inventories magnify fulfillment complexities. Even the most sophisticated e-commerce retailers, or e-retailers, wrestle with this challenge, but AS/RS high-density storage and fulfillment automation has proven very effective in addressing it. Grocers are faced with the added challenges of managing dry goods, refrigerated and frozen inventories.

- Labor challenges — Nearly one-third of distribution and fulfillment (D&F) operations experience turnover rates between 25 and 100%[6]. These high turnover rates, combined with shortages of qualified staff and rising minimum wages, is a leading driver for digital transformation and the acceleration of automated fulfillment processes. Labor management software (LMS) utilizes patented algorithms to detect behaviors that could indicate when an employee may leave. As a result, operators can make real-time labor optimization decisions and take actions to retain top performers or proactively replace them.

- Online grocery — E-commerce retail has thrust many leading grocers into unfamiliar waters, as most were not equipped to meet the demand for online fulfillment. It’s estimated that grocers incur a loss of $5–$15 on every manually picked online grocery order[7]. Developing cost-effective and efficient click-and-collect and home delivery fulfillment models is a key to long-term survival.

- In-store fulfillment disruptions — Aisles filled with BOPIS order picking technology can create unpleasant shopping experiences for in-store clientele[8]. The added fulfillment burden also can reveal replenishment process inadequacies, which can result in a variety of stocking issues — such as out-of-stock items; the inability to fulfill online orders; and frustrated shoppers.

- Fast, flexible implementation — The ability to respond quickly to dynamic market demands has become a true strategic differentiator for retailers. Natural disasters and supply chain disruptions can create unexpected surges in online demand. Retailers need flexible and scalable micro-fulfillment solutions that can be implemented quickly to meet unpredictable e-commerce fulfillment demands[9].

Download our infographic, The Macro Trends Behind Micro-Fulfillment Centers, to learn more about the market conditions and emerging technologies that are available to help you establish a winning omnichannel fulfillment strategy.

To subscribe to our blog and receive exclusive communications and updates from Honeywell Intelligrated, click here.

Sources

_______________________

[1]https://www.statista.com/topics/2477/online-shopping-behavior

[2]https://www.invespcro.com/blog/same-day-delivery

[3]https://www.invespcro.com/blog/buy-online-pick-up-in-store-bopis

[4]https://www.un.org/development/desa/en/news/population/2018-revision-of-world-urbanization-prospects.html

[5]https://www.cbre.us/research-and-reports/2020-US-Real-Estate-Market-Outlook-Industrial-Logistics

[6]https://www.dcvelocity.com/articles/29021-nine-ways-to-boost-warehouse-performance-and-cut-turnover

[7]https://www.forbes.com/sites/brittainladd/2019/02/01/crossing-the-rubicon-why-2018-was-the-point-of-no-return-for-online-grocery/#45ffdba74467

[8]https://www.wsj.com/articles/traffic-jam-in-aisle-three-whole-foods-is-crowded-with-shoppers-filling-online-orders-11572281343

[9]https://www.forbes.com/sites/lanabandoim/2020/03/06/coronavirus-increases-demand-for-online-grocery-shopping-as-retailers-struggle-to-keep-up/#6503e8de761a

Let's Connect!

Sign up to receive exclusive communications from Honeywell including product updates, technical information, new offerings, events and news, surveys, special offers, and related topics via telephone, email, and other forms of electronic communication.

Copyright © 2025 Honeywell International Inc

Maximum File Size

Maximum Files Exceeded

Due to inactivity you will be logged out in 000 seconds.

Maximum File Size

Maximum Files Exceeded

You cannot access this page as this product is not available in your country.